Setup IRS Forms

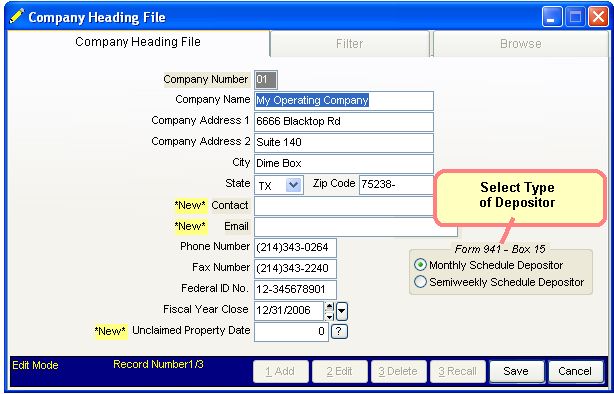

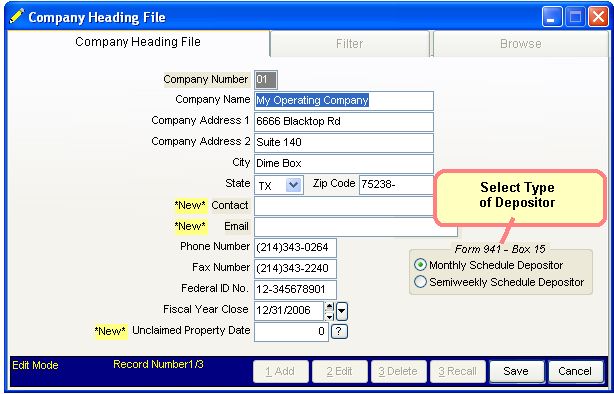

Before you can print the IRS Form 941 Schedule B, you need to use the Company Headings File to select the type of depositor you are, for each company. The IRS requires SemiWeekly Depositors to complete and file Schedule B of the IRS Form 941.

Select Master - Company Headings File

For each Company you are using, select whether you are a monthly or semi-monthly depositor so the program will know to complete the first section of 941 or Schedule B.

Specific instructions from the IRS to determine whether you are a Monthly or SemiWeekly Depositor can be found on page 3 of Information on IRS Form 941 from IRS Website. Basically, for year 2006, if your Payroll tax liability for the previous 4 quarters was $50,000 or less, you are a Monthly Depositor. If you have questions about this, read the document from the IRS (mentioned above) or consult your Accountant.

Related Topics

Toll Free Number for IRS Help = 1-800-829-4933

Information on IRS Form 941 from IRS Website

Instructions for IRS Form 941 Schedule B

IRS_94x_and_EFTPS Help System - 07/31/06 6:30am Copyright © 2006, Roughneck Systems Inc.